Autumn Budget 2025 Key Predictions

Updated 17 Nov 2025

Categories

As the next UK’s Annual Autumn Budget approaches, speculation and predictions have increasingly captured the attention of both the media and the public.

Whether you're planning to buy your next home or saving up for retirement, the upcoming changes will most likely affect you in some way.

There has been a lot of talk around pension, ISAs, and tax changes, and we will aim to unpack these as simply as possible in this article.

Scheduled for 26th November, this year’s budget needs to account for not only the government’s pledges, but also for internal and external circumstances, including fiscal pressures, slowing economic growth, rising living costs, and the impacts of international market volatility.

Rachel Reeves, however, has made assurances that she will be making ‘the necessary choices to deliver strong economic foundations’.

Why This Budget Matters

The UK’s public finances remain under significant pressure, with borrowing and debt levels elevated.

In the six months to September 2025, public sector borrowing increased in comparison to the same period in 2024 by around £11.5bn. For September alone, net borrowing hit £20.2bn - the highest September figure since the pandemic.

This combination of continued large budget deficits and a debt burden leaves the Chancellor with little room for manoeuvre. Even modest downward revisions in growth forecasts or upward surprises in interest costs will force hard choices.

To compound this, the Government’s own framework explicitly aims for debt to fall as a share of GDP, and for day-to-day spending to be contained.

In terms of what this means for the budget, in practice this means that either tax rises, spending cuts or a combination thereof are increasingly inevitable.

Pensions: What changes are being rumoured?

With pensions having been subject to a substantial tax raid in the 2024 Autumn Budget, it would seem to be an interesting decision to make further changes to the pension regime.

However, there are continued rumours of there being some overhaul to restrict the tax relief available.

A significant portion of the benefit is channels to high earners which, based on the messaging and policy that's been put into place so far, seems like an area of the working population that the government is happy to target to look to close the budget deficit.

Primary rumours suggest a limitation of the pension commencement lump sum, and also a cap on salary sacrifice.

Could Tax-Free Lump Sums Be Limited?

In what seems to be a perpetual rumour, there is again to talk of limiting the lump sum available.

Currently, most people can take 25% of the value of their pension scheme tax-free at retirement age, with the current cap on this being £268,275.

There has been speculation around this, but Reeves has largely discounted this thus far.

Salary Sacrifice: Why a New Cap Is Being Discussed

Salary sacrifice provides a particularly tax efficient mechanism for moving funds into a pension scheme.

This means that employees and employers don't have to pay national insurance which isn't recoverable via pension contributions.

If a salary sacrifice limit were put into place, with figures as low as £2,000 being talked about currently, then this would reduce the amount of money that employees can channel into their pension funds to mitigate income tax and national insurance contributions owed on the funds.

ISAs: Will the Annual Allowance Be Cut?

ISAs are a staple of people’s finances in the UK and are one of the few simple tax-shelters for hard earned savings.

They are particularly attractive as they allow people to save money without paying income tax or capital gains tax on any interest and investment growth.

Currently, the annual allowance is set at £20,000 per tax year. This amount, however, is rumoured to be lowered to £10,000 instead, representing a 50% decrease.

Could Cash ISAs Be the Main Target?

Some speculate this reduction will target cash ISAs rather than all ISA types, as Reeves aims to encourage investing over holding cash.

Her aim is to ensure that the government ‘gets the balance right’ between cash and shares, and by encouraging investment rather than saving, the Treasury hopes to boost the UK’s capital markets.

Inheritance Tax: Where Adjustments Could Happen Next

It has already been announced that as of April 2027, private pensions will also be subject to IHT, meaning they are no longer an efficient way to pass on wealth.

Considering the substantial contribution of IHT to the treasury’s tax take (approximately £6.7 billion in 22-23 tax year!), it could be an area targeted for additional tax hikes.

Whilst messaging appears to be vague around whether the government will backtrack on the promise to avoid tax raids on working people, increasing the IHT burden faced by wealthier individuals (and decreasing the threshold at which people are ‘wealthy’ enough to pay IHT!) could be the most appealing of an overall unappealing set of options.

The two primary areas potentially on the table to be impacted are an extension of the 7-year gifting rule and a cap on the amount of gifts people can make over their lifetime.

Extending the 7-Year Gift Rule

Currently, dependent on the gift donor outliving the 7-year period from the date the gift is given, a gift made will fall out of the donor's estate, therefore, is completely exempt from IHT.

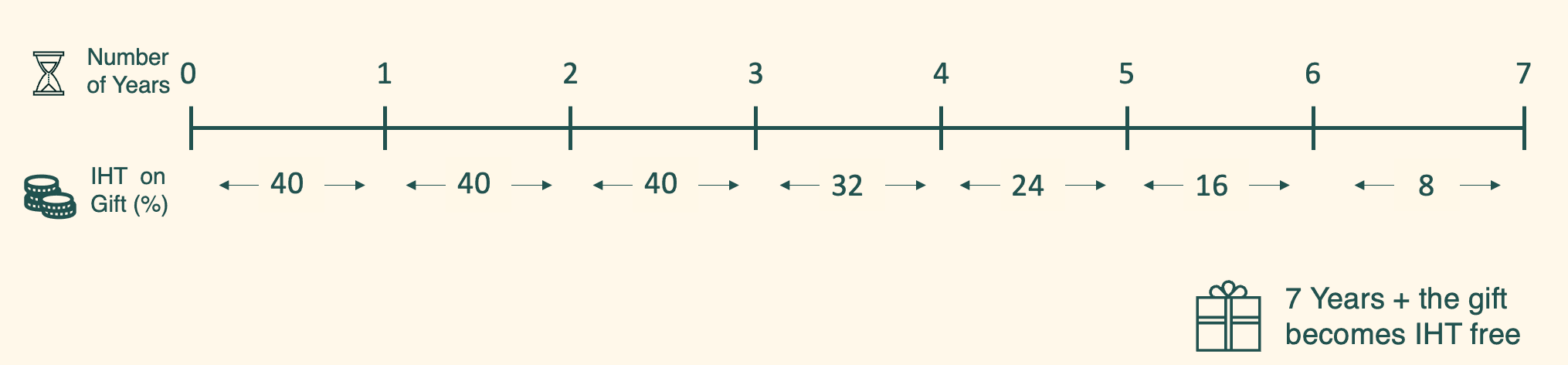

Should the gift donor not survive the full 7-year period, the gift will remain within their estate and will be subject to IHT.

However, the tax payable on the gift may be reduced due to taper relief, which applies to the 3-to-7-year period after the gift was given. The below shows this:

The gifting mechanism is a component of most IHT strategies, and therefore by increasing the amount of time it takes for a gift to leave the estate would increase the tax take substantially.

Setting a Lifetime Cap on Gifts

Another potential rule change that would have a significant impact would be the implementation of a lifetime cap on gifts.

This is something that can be seen globally, with a cap on lifetime gifts in the US (albeit a much more generous figure at c. $13.99m!). This is unified with the estate tax exemption, meaning that gifts made in a lifetime can reduce the amount that can be passed on tax-free after death.

This would mean that gifts would become reportable and potentially the amount that could be passed on to individuals without being subject to lifetime tax charges could be reduced.

There is currently a ruleset in place for Chargeable Lifetime Transfers (CLT) that caps gifts to discretionary trusts to the available nil-rate band (NRB), effectively capping this at £325,000 per person in a 7-year period without a 20% charge applying. A similar ruleset could very well be extended to gifts to individuals.

Income Tax and National Insurance (NI): What Might Change?

Despite pledging not to touch income tax or employee national insurance (NI), some speculation has been made around increasing these.

On the one hand, the independent think-tank Resolution Foundation has proposed a 2p increase in income tax and a 2p decrease in employee NI, aiming to protect the working class and target pensioners and landlords - two areas that would fall outside of the ‘working people’ manifesto pledge, and are traditionally seen as wealthier segments of the UK population.

Could NI Be Added to Rental Income?

There have also been some discussions on adding NI to rental income from landlords, which could potentially raise approximately £2.3bn a year.

This would further hurt landlords who have been impacted by greater protections being available for tenants as part of the Renters’ Rights Act.

Whatever Happens Next, We’ll Help You Navigate It

Whatever the new Chancellor has in store for this budget, we’ll be ready to analyse and dissect what any changes may mean for you and your finances.

If you have any queries relating to your finances before the budget, or if you’d like to be among the first to receive our analysis of the budget, you can contact our team.

*Information correct at the time of publishing. This article is provided for information purposes only and should not be taken as individual advice. Aventur is not responsible for the content of 3rd party websites.